Interchain Security and Centralization

Consumer Chain on-boarding and centralization

The following is an excerpt of an analysis detailling how Interchain Security Module for Cosmos Hub creates centralization pressure by imposing asymmetric economic taxes on small- and large validators.

The full analysis can be found on the Cosmos Hub Forum, and is a collective effort with Umberto from Chorus One research.

While running a validator incurs fixed costs, the revenue collected from consumer chains is variable as a function of voting power.

Currently, for a majority of the validator set, each ICS revenue stream appears insufficient to cover the fixed cost associated with operating an additional node for a consumer chain.

Therefore, this manifests as centralization pressure, including in the following ways -

- Small validators may need to terminate operations, causing delegators to seek out more stable options, i.e. delegate to large validators.

- Small validators especially may have to compromise on cost, decreasing their security and consequently attractiveness.

- Large validators will have relatively more income at their disposal.

This situation can be framed as a fixed tax imposed on the validator set. Small validators may not be able to afford it, leading delegators to prefer large validators over the long run.

Large validators now control more stake, and delegators earn higher yields due to consumer chain emissions.

However, this benefit is generated at the expense of decentralization, i.e. staking on Cosmos Hub just shifts on the risk <> return curve.

Large validators win, delegators ostensibly win, small validators lose.

Let’s proceed by outlining the current expected revenue, and deriving the revenue multipliers that would have to be realized for the current model to be profitable to validators with 0.4% and 0.2% of the voting power on the Hub respectively.

In practical terms, at the time of writing:

- 74.4%% (134/180) of validators on the Hub have a voting power <= 0.4%.

- 52.7% (95/180) of validators on the Hub have a voting power of <= 0.2%.

The below analysis does not take into account a revenue share from MEV rewards. This is a limitation. Therefore, the profitability multipliers given below refer to the combined impact of MEV, and future growth on the other revenue streams.

On the flipside, it also does not take into account any reduction in the inflationary staking rewards on Stride - this is a simplified snapshot, to kickstart a discussion.

In conclusion, asuming the on-boarding of 10 consumer chains, revenues would have to increase by:

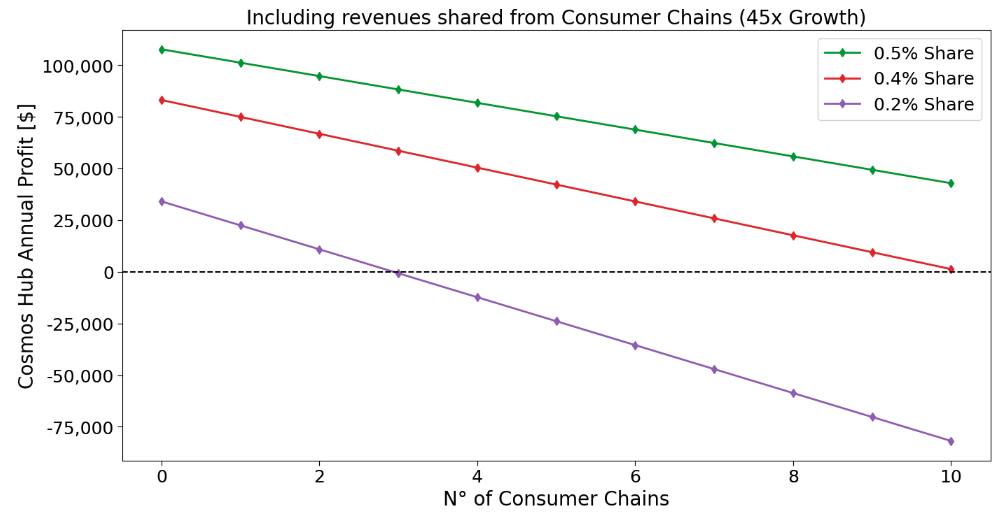

- 45x for 3/4 of the validator set stay profitable.

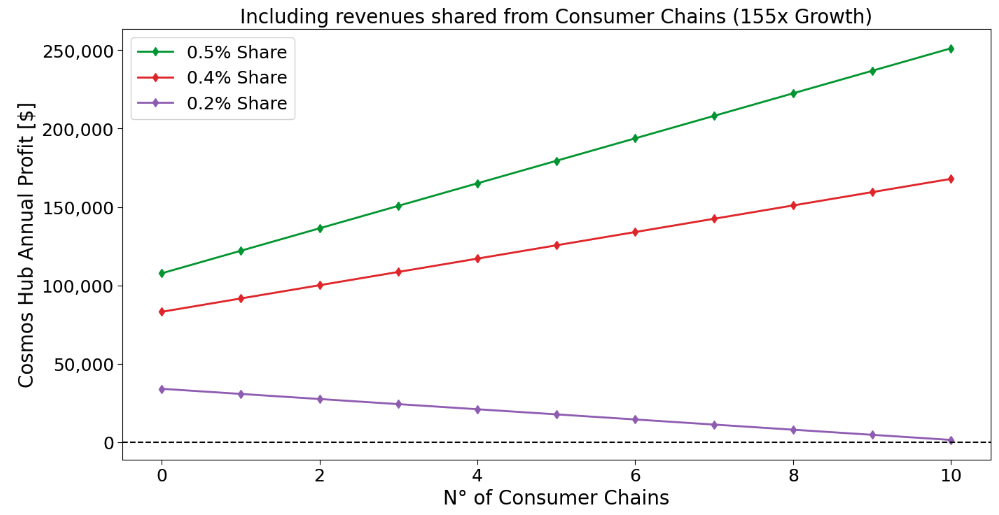

- 155x for 1/2 of the validator set stay profitable.

Payoff diagrams

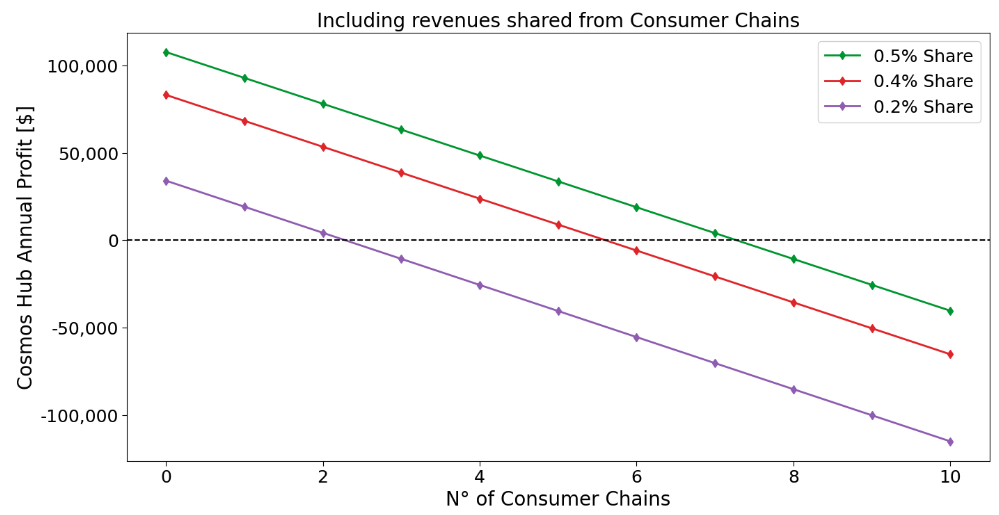

Assuming the calculations above as a proxy for all past- and future consumer chains, the current state reflects as the following payoff graph:

Under the status quo, if validators with a 0.4% share were to be profitable in the longer run, we’d need to apply a 45x multiplier to our revenue forecast:

Under the status quo, if validators with a 0.2% share were to be profitable in the longer run, we’d need to apply a 155x multiplier to our revenue forecast: